top of page

News & Insights

Non-performing loans skyrocket at Vietnamese banks due to dismal business performance

The latest financial statement of TPBank showed the bank's total NPLs by the end of the second quarter increased by nearly three times

Aug 7, 2023

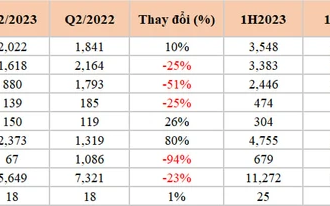

There are 10 banks announcing business results for the first 6 months of 2023

Up to now, 10 banks have announced their business results for the first 6 months of 2023. In general, the profit growth has slowed down

Jul 26, 2023

The highest credit room extension up to 4% to a bank

Sacombank leads the list with increased credit room at 4%. Other banks such as Agribank 3.5%, MB 3.2%, SHB 3.2%, VIB 3%, Vietcombank 2.7%.

Sep 13, 2022

Moody's Investors Service has raised the ratings of 12 Vietnamese banks

Moody's Investors Service has raised the ratings of 12 Vietnamese banks following its upgrade of Vietnam's sovereign rating to Ba2 from Ba3.

Sep 12, 2022

Banks need to tighten control of their corporate bond investments

Banks must tighten their assessment control of corporate bond investments to avoid excessive risk and the misuse of funds raised by firms.

Aug 19, 2022

Tags cloud

bottom of page